Join Now + Put Your HSA/FSA to Work

Equinox has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Savings Account (FSA) towards your Equinox Membership.

Join Now

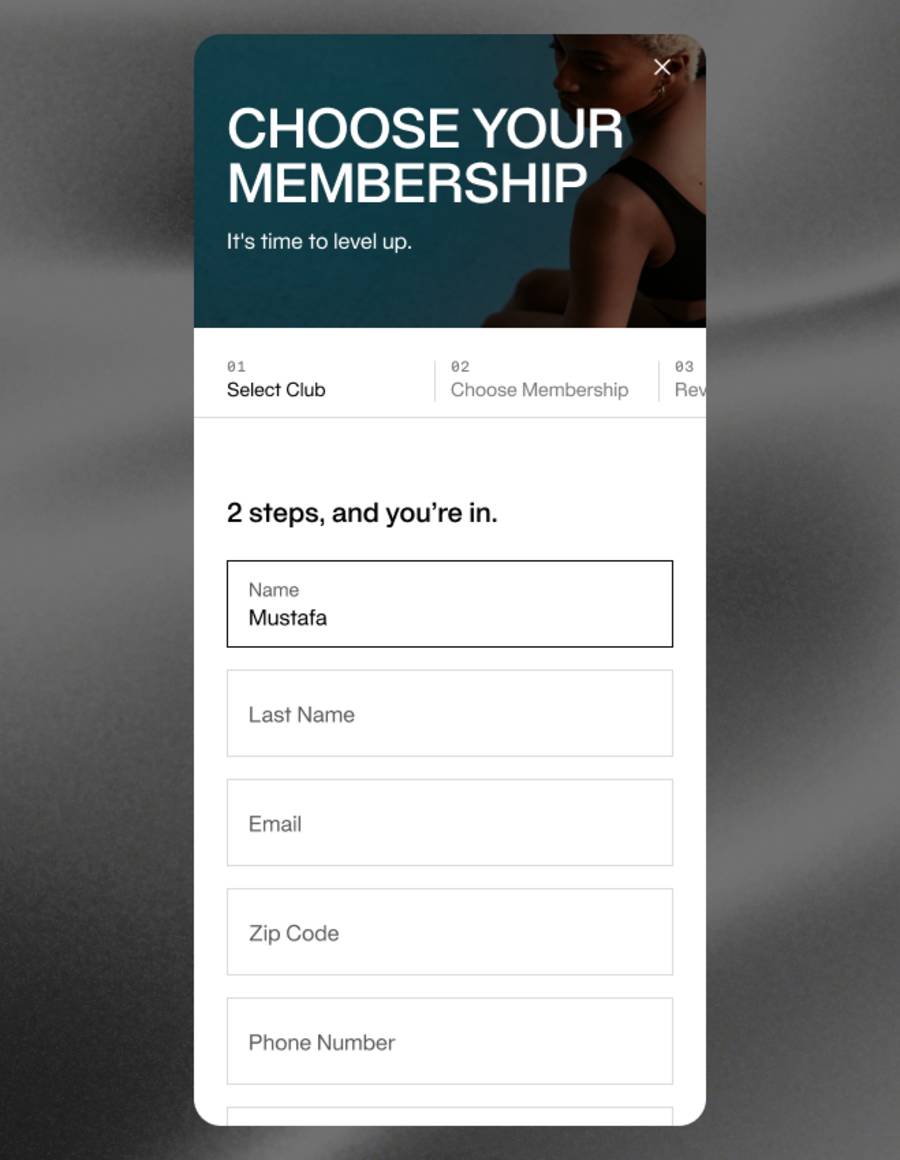

HOW TO USE YOUR PRE-TAX FUNDS

Step 1: Become a Member

Join Equinox and purchase your Membership.

Step 2: Go to Flex

After Membership enrollment is complete, you’ll land on the “Let’s Get Started” page. Select “Apply Now” to be redirected to the Flex website.

Step 3: Confirm Eligibility

Answer a few quick questions to apply for a Letter of Medical Necessity and see if you are eligible (under 2 minutes). Add your HSA/FSA payment details and submit your application with Flex.

Step 4: Enrollment Confirmed

If approved, you'll receive an email with your Letter of Medical Necessity and your membership dues will be automatically charged to your HSA/FSA card going forward. This information can be found in the “Membership & Billing” page on the EQX+ app.

FREQUENTLY ASKED QUESTIONS

What are Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA)?

HSA and FSA accounts allow you to set aside funds before taxes are taken out of your income for eligible health and medical expenses.

What is a Letter of Medical Necessity (LMN)?

A Letter of Medical Necessity is a document from a licensed healthcare provider that confirms your Equinox membership is recommended to support a specific medical or health-related condition. This letter is required by the IRS in order to use HSA or FSA funds for monthly membership dues.

Flex, our third party partner, helps facilitate the LMN process. Approval is not guaranteed and eligibility is determined based on the information you provide during the application.

Who is Flex?

Flex is Equinox’s third-party partner that, through licensed healthcare providers, helps determine eligibility for using HSA or FSA funds toward your Equinox membership. Flex manages the enrollment process, facilitates Letters of Medical Necessity, and securely processes HSA/FSA payments.

Flex operates independently from Equinox and does not share your personal medical or health information with Equinox.

How does using HSA/FSA funds save me money?

Your savings depend on a few factors, including your tax bracket and your monthly membership dues. Any potential savings comes from using pre-tax dollars.

Are there any fees when I use my HSA/FSA card for my Equinox membership or services?

Yes. There are two fees to be aware of:

Letter of Medical Necessity (LMN) Application Fee Flex charges a $10 fee each time you apply for a Letter of Medical Necessity (LMN). This fee is charged to your HSA/FSA card whether the LMN is approved or not and is non-refundable. This fee is non-refundable. Equinox cannot waive or refund this fee. Any questions about this charge should be directed to Flex.

Monthly Service Fees Flex collects a monthly service fee equal to 4% of your total payment (monthly dues plus tax, where applicable), along with a $0.30 monthly processing fee.

What can I pay for using my HSA/FSA?

Eligible members can use HSA or FSA funds to pay for monthly billed Equinox membership dues only.

Will Equinox receive my medical information submitted to Flex?

No. Flex does not share your medical or health information with Equinox.

ENROLLMENT

What happens if I’m not approved? Who should I contact?

You’ll be notified during the application process if you’re not eligible. If you have additional questions, please contact Flex directly at support@withflex.com.

I’m an existing member. How do I switch my payment to my HSA/FSA card?

You can switch your payment method directly in the EQX+ app:

Go to Profile

Select Membership & Billing

Scroll to Pay with HSA/FSA and tap Enroll

You’ll be redirected to Flex, where you can apply for a Letter of Medical Necessity and confirm whether you qualify to pay with your HSA/FSA funds.

Do I need to keep a personal credit card on file?

Yes, you must keep a personal credit card on file in case your HSA/FSA balance is insufficient to cover your full membership dues. Partial payments using HSA/FSA funds are not supported at this time.

BILLING & ACCOUNT MANAGEMENT

When will I start being billed using my pre-tax HSA/FSA funds once approved?

In most cases, billing to your HSA/FSA funds will begin on your next scheduled billing date. If you’re approved before the 21st of the month, we’ll attempt to collect payment from your HSA/FSA account for that billing cycle.

If there are any processing delays on Flex’s side, your first HSA/FSA payment may be applied starting the following month.

What day will I be charged if I’m paying with an HSA/FSA account?

Once your eligibility is confirmed, Flex will attempt to charge your HSA/FSA card on the 22nd of each month.

If your HSA/FSA account has insufficient funds to cover the full membership dues, your membership will be charged to the personal credit card on file on the 23rd of the month. Charges made to your personal credit card cannot be reversed or switched back to HSA/FSA for that billing cycle. Flex will attempt to use your HSA/FSA account again the following month.

How do I update the HSA/FSA card on file with Flex?

To update your HSA/FSA card with Flex, please contact Concierge. They’ll send you a secure link from Flex where you can update your HSA/FSA account information directly with Flex.

How do I stop paying with my HSA/FSA account?

If you’d like to discontinue payment using your HSA/FSA account, please contact Concierge before the 15th of the month. Requests received after the 15th may take effect in the following billing cycle.

How can I tell if I’m enrolled in HSA/FSA billing?

You can check your enrollment status in the EQX+ app by going to Membership & Billing, where you’ll see whether your HSA/FSA payment method is confirmed.